child tax credit 2021 october

Some have already chosen to unenroll from the monthly. Businesses and Self Employed.

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

In previous years 17-year-olds werent.

. October 15 2021 1042 AM CBS Los Angeles. 1252 PM CDT October 15 2021. Families may earn a 3000 tax credit for.

Ad The new advance Child Tax Credit is based on your previously filed. Last year the Child Tax Credit got a lot of press for its major enhancement. The cash will come in the form child tax credits due.

For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit. Parents that had a child in 2021 can claim the child tax credit if they meet certain requirements. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

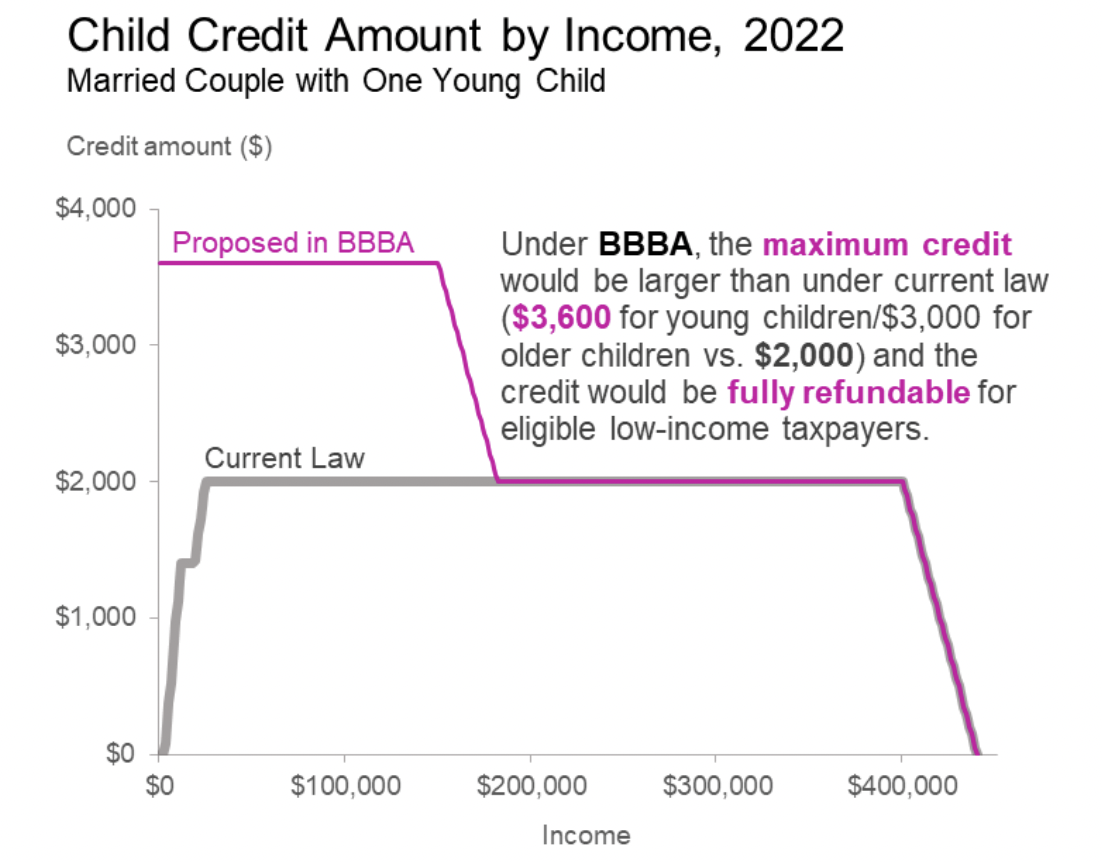

The child tax credit is worth 3600 for children ages 5 and under and 3000 for children ages 6 through 17 at the end of 2021. From July to December eligible parents. In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

Previously most taxpayers could save up to 2000 per child on their federal income tax payment. The credit is 3600. 21 hours agoAnother big credit got a boost.

CBS Detroit -- The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on. IR-2021-201 October 15 2021. The couple would then receive the 3300 balance -- 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child -- as part of their 2021 tax refund.

November 1 2021 is an important date for two different reasons. The child tax credit was temporarily expanded under President Joe Bidens American Rescue Act in 2021 to 3600 from 2000. How much is the 2021 child tax credit.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Child Tax Credit 2021. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from.

Heres when the fourth check will deposit Aimee Picchi 10142021 More than 100000 people hospitalized with Covid-19 for first time in nearly four. But theres another lesser-known credit that rose substantially for the. As part of the.

October Child Tax Credit payment kept 36 million children from poverty. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. December 09 2021 1024 am.

Thats an increase from the regular child tax. October 29 2021. After October two more monthly payments remain and then the last half can be claimed on the 2021 tax return.

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and. IR-2021-201 October 15 2021. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail on Friday.

The opt-out date is on November 1 so if. Child tax credit payments. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

1122 ET Oct 10 2021 PAYMENTS worth around 15billion are set to be sent out to American families this week. The American Rescue Plan Act expanded the credit increasing the amount of. Goods and services tax harmonized sales tax GSTHST.

Child Tax Credit 2021 8 Things You Need To Know District Capital

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit 2021 How Much Is It And When Will I Get It

What Are Marriage Penalties And Bonuses Tax Policy Center

Child Tax Credit 2021 How Much Is It And When Will I Get It

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Expiration Of Child Tax Credits Hits Home Pbs Newshour

Child Tax Credit Children 18 And Older Not Eligible 13newsnow Com

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2021 8 Things You Need To Know District Capital

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities